If you are preparing for your Mortgage Brokerage Exam in Alberta and wish to become a Licensed Mortgage Broker in Alberta, one of the biggest questions you must be pondering on would be – What to expect in the Mortgage Brokerage Exam in Alberta? So, we have something for you!

We are here to tell you everything you need to know before appearing for the Exam – from the Types of Questions and Number of Questions you can expect to Updated Exam Weightings for the Mortgage Brokerage Exam as well as Time Management Tips to Pass the Mortgage Brokerage Exam in the first attempt. With the help of our advice and suggestions, you can give your best shot!

INFORMATION ON THE MORTGAGE BROKERAGE EXAM IN ALBERTA

1. Exam Format

The format of the Mortgage Brokerage Exam is completely Digital – Computer-based. It is taken entirely on a Computer and there is no need for any hand-written content to complete the exam. Please note that it is NOT an Online Exam as some COVID-related rules have been lifted. Although, it was conducted online for a while when the restrictions were in place. But as of Sept 2021, the Exam has to be taken at the RECA-Approved Exam Centres nominated for each of the applicant. When you apply for the exam through your RECA portal, you can see the exam centre that is nominated to you by RECA and visit the centre on your exam day to attempt the exam.

2. Total Number of Questions

The total number of questions that you can expect in the Mortgage Brokerage Exam in Alberta would be 100.

3. Question Format

All the questions that you will get in the exam will be MCQs or Multiple-Choice Questions.

4. Exam Duration

The total duration of the exam is 3 Hours.

5. Passing Criteria

In order to pass the exam, you have to score a minimum of 70% i.e., 70 correct answers out of a total of 100 Questions in the exam. In other words, the passing marks for the exam is 70 marks.

6. Results

The beauty of this exam format is it gives you Instant Results once you are done with all the questions. As soon as you complete all the questions, you get the result of Pass or Fail right away on your Computer Screen. This way you don’t have to wait worrying about them for a long time. In addition to this, for your benefit, the results give a summary of your overall performance in the exam based on individual units of each of the courses. Although, it will not specify your performance on particular questions, but it will give you a synopsis of your performance unit-wise.

7. Total Number of Attempts

There are a total of 2 Attempts given in order to clear the Mortgage Brokerage Exam. If you fail to clear the exam in the first attempt, you have a second attempt available. Again, a plus point is that you can give the 2nd attempt as soon as 24 hours after completing your exam. This gives you the flexibility to appear for the exam sooner when you are still in that exam preparation mode.

Note: If you fail in both the attempts and are not able to clear your exam, you will have to re-apply for your Courses with RECA by paying the fees again and then repeat the whole process again. It is thus, better to prepare for the Mortgage Brokerage Exam properly to ensure you don't have to take this route and pay double RECA Fees.

Now, its good to know all the information about appearing for the Exam, but the question remains – How to Pass the Mortgage Brokerage Exam in Alberta? What is the strategy??

Well, let’s look in to it.

STRATEGY TO PASS THE MORTGAGE BROKERAGE EXAM IN THE FIRST ATTEMPT

1. Education Requirements

In order to become a Licensed Mortgage Broker in Alberta, you will have to enroll in the Mortgage Associates Program (MAP) issued by the Mortgage Licensing body of Alberta – Alberta Mortgage Brokers Association (AMBA).

The MAP consists of 2 Courses – Fundamentals of Mortgage Brokerage Course & the Practice of Mortgage Brokerage Course. MAP costs $2,800 and you must complete the program within 1 year.

2. Types of Questions you can expect on the exam

A. Definition Questions

These questions will relate to any kind of term that they can ask you to define. So, they can either give you a term to define and they will ask you for the definition of that term or they can give you a definition and they will ask you what term that describes. For example, concepts like Mortgage Broker, Amortization Period, Closing Costs, Closed Mortgage, CMHC, etc. These are all the terms that we need to understand as Mortgage Brokers, and they can ask you to describe these terms on the exam or they can ask you what this sentence describes. Definition Questions are very common and one should definitely be prepared for these type of questions.

B. Scenario Questions

One of the most difficult types of questions to expect in the Alberta Mortgage Brokerage Exam would be scenario or situational questions. Scenario questions basically ask you who, what, when, where or why of any situation. So, they will give you a scenario and based on that, you will have to answer the given question. These types of questions are best answered by understanding the concepts. So here, we are not trying to memorize a term, but we must go deeper and really understand the concept so that we can answer these types of questions.

C. Math/Calculation Questions

There will be some Math-related Questions in the Exam. The first course (Fundamentals) will not have a lot of math questions whereas, the second course (Practice) has comparably more calculative topics than the first course.

3. Exam Weightings

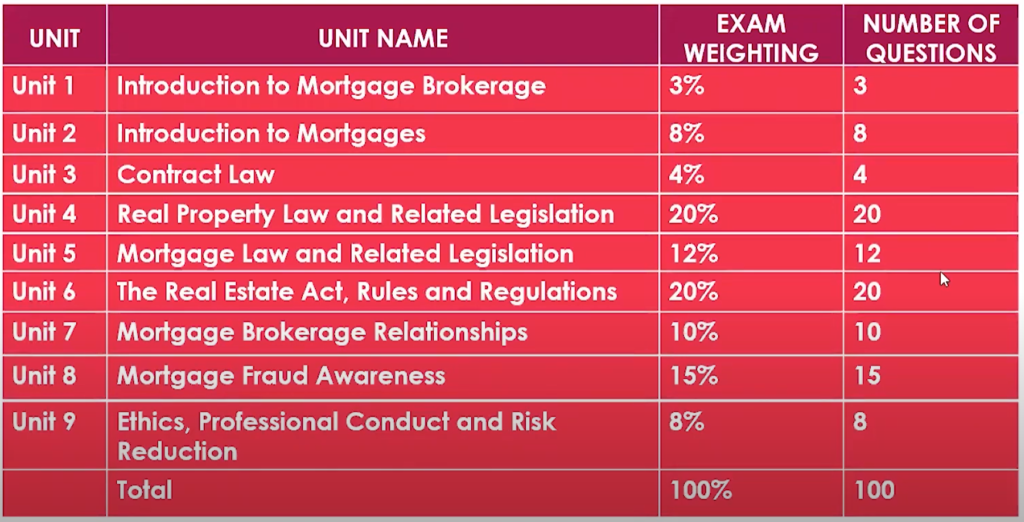

The Course content for the Mortgage Brokerage is divided based on Units. Unit-wise distribution is important and helpful as it categorizes the content based on various sub-topics and gives a clear idea of each of the topics in detail. It is also important from the exam perspective because AMBA prepares questions based on essential sub-topics i.e., Units. Thus, there are some units that are more important from an exam preparation view.

For instance, in the Fundamentals of Mortgage Brokerage Course, the following table shows the exam weightings for each of the units along with the number of questions that can be expected from each of them. Have a look –

4. Time Management Tips for the Exam

Now, there are 3 hours to complete the exam and a total of 100 questions. This means that you can spend less than 2 minutes per question on an average, in order to attempt all the questions and complete the exam on time. We recommend to defer the questions that you may feel difficult and keep them for the end to prioritize easy questions. This will help you save time and give you more time to think for questions that are difficult and time-consuming.

Alberta Real Estate School is here to help you guide in the smallest of doubts and the biggest of questions that you can ask for. Get to know –

How to qualify for a Mortgage Brokerage License Application in Alberta?

Join Alberta Real Estate School for expert help with understanding the concepts of Real Estate and getting uncommon and detailed tutoring sessions summarized as per your needs. Get our personalized Notes designed to get you through the Real Estate Exams in the first attempt! Visit our list of Real Estate Tutoring Sessions for details.

If you have any doubts for Exam Preparation of any of the real estate courses or topics, reach out to us directly at 587.936.7779.

Happy Studying!

You can also listen to this article in the podcast above. We hope you found this information useful. Stick to us for more updates.