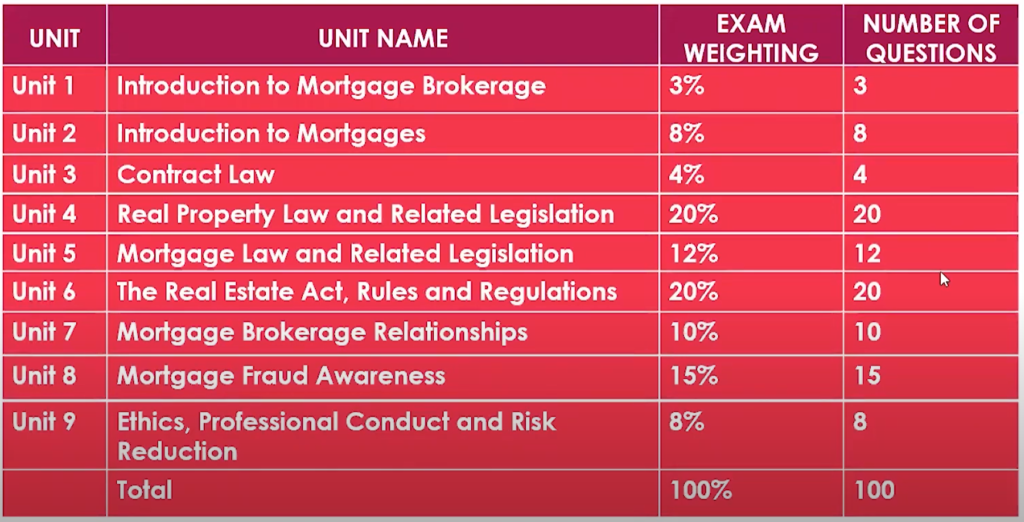

The Real Estate Exam in Alberta is a very tricky exam. There are a lot of topics to understand. Thus, the Alberta Real Estate Exam Format is also designed to match the format of the content. Alberta Real Estate Exams are multiple-choice and thus, the questions asked in the exam are divided in to:

[I] Definition Questions

Definition Questions go with their name. They do exactly what they say i.e., Terms or Definitions. So, they can either give you a term to define and they will ask you for the definition of that term or they can give you a definition and they will ask you what term that describes. For example, things like real property, real estate, land, GDP, etc.

[II] Scenario Questions

One of the most difficult types of questions to expect in the Alberta Real Estate Exam would be Situational or Scenario Questions. Scenario questions basically ask you who, what, when, where or why of any situation. So, they will give you a scenario and based on that, you will have to answer the given question.

Let’s try to understand some Sample Real Estate Questions with Solutions –

Examples of Real Estate Exam Questions in Alberta

Example 1

Which of the following statements best describes the concept of Scalable Enforcement under RECA’s professional conduct review program?

- RECA will consult the courts and other governing bodies to impose disciplinary sanctions

- Disciplinary Sanctions will be first carried out by the brokers and then referred to RECA if the same infraction occurs

- Industry Professionals will receive sanctions that can and will escalate upon future occurrences of the same activity

- Failing to comply with brokerage policies and procedures will result in monetary fines that increase with each breach

Correct Answer: 3

Rationale: So, in this case, it is a Scenario Question. The reason of the statement being true is RECA will put an easier Sanction initially, but if the other party does not improve their behavior and keep repeating the same mistakes again and again, the Sanctions will be higher. So they will escalate upon future occurrences of the same activity.

Example 2

Which of the following statements is an example of an inappropriate inducement?

- A brokerage agrees to pay the buyer’s moving costs to close a transaction

- A brokerage ad states that it will pay the appraisal fee for all the first time home buyers

- A real estate professional agrees to pay the first mortgage payment to get new business

- A real estate professional pays for the seller’s window repair to make the sale

Correct Answer: 4

Rationale: So, in this case, they are asking us which of the following is an Inappropriate Inducement. It is a Definition Question. So, you have to understand the Definition of Inducement and apply the understanding of the concept to answer the question. Now, if you have learnt the concept thoroughly, you will know that paying the cost of window repair of a seller is not a Real Estate Agent’s liability. Thus, the answer is 4.

Example 3

Which of the following applies to the payment of Referral Fees?

- Real Estate brokerages may be paid Referral Fees by Mortgage Brokerages

- Real Estate Professionals may pay referral fees to mortgage brokerage professionals

- Real Estate Professionals may pay referral fees to unlicensed individuals if the broker approves

- Real Estate Professionals may be paid referral fees by mortgage brokerages

Correct Answer: A

Rationale: This is again a Definition Question. According to the concept of Referral Fees, Real Estate Agents are allowed to pay Referral Fees. However, they have to be paid through the Brokerage and not directly. So, the process goes as – We send Referral Fess to Mortgage Brokerage and then the Brokerage sends the fees to the Mortgage Brokers.

Example 4

Which of the following Disclosures are required by a brokerage when one of its real estate professionals wants to purchase a property that the brokerage has listed for sale?

- Disclose to the client the name of the real estate professional

- Disclose to the client the existence of a conflict of interest

- Disclose to the client the opportunity to seek independent advice

- All of the above

Correct Answer: 4

Rationale: If a real estate professional wanted to buy a property that is listed by another agent in the same brokerage, it means that the brokerage is representing the seller. So, in this case, we would have to do some disclosures and we would have to disclose the name of the real estate professional who is involved. We would have to say that there is a conflict of interest and the client will have the opportunity or we have to provide them the opportunity to seek independent advice on how to proceed. Thus, our correct answer here is D – All of the above.

Example 5

The rules require an individual trading in real estate to hold an authorization with RECA unless they are exempt. Which of the following is not exempt?

- A person acting directly by statute or court order to dispose of real estate

- A bank, credit union, loan corporation, trust corporation or insurance company administering real estate

- A full time assistant that holds open houses for a real estate professional

- A member in good standing of the Law Society of Alberta when in the practice of law

Correct Answer: C

Rationale: The person who is acting based on a court order and they are auctioning of the property or it’s some sort of a foreclosure and they’re dealing with the property, that person does not require a license anything under the court order does not require a license because they’re only working with one particular property that the court is dealing with. So, they don’t require a license.

Generally, when there’s a foreclosure or anything like that, they will hire a real estate professional to represent and that’s why we don’t have to worry about it. So anything under the court is completely exempt. Also any kind of bank, credit union, loan corporation, all these types of companies are allowed to provide mortgages. Normally, you would require a license from RECA or authorization from RECA in order to get mortgages. However, in this case, these companies fall under their own regulation.

So for example, if it’s an insurance company like Manulife, they give out mortgages but they would fall under the Insurance Act and therefore, they don’t have to go through RECA under the Real Estate Act, Same way, a bank or a credit union they have their own banking regulation or credit union regulations that they fall under and therefore they are exempt from RECA authorization because they already have a similar regulation that they fall under.

Here, Option D states a lawyer. Basically, we will work with lawyers in closing the transactions and lawyers do not fall under RECA’s jurisdiction. Again, because they are under the Law Society of Alberta. They have their own rules that apply to them. In case of Option C, it refers to a full-time assistant that holds open houses for a real estate professional. Now, the problem here is a full-time assistant is not allowed to do open houses. So, this is act in person when we have contract with somebody. We are the ones who are supposed to act on behalf of that person. We are the one with authorization. If a person is working as a full-time assistant that means they’re unlicensed and they’re not allowed to do open houses for us. They’re not allowed to represent a client, sign a contract or do any of those things. So, all those activities require a license. Thus, a full-time assistant would not be able to do this transaction, they would need a license. So they’re not exempt.

Example 6

Which of the following groups of statements are correct regarding the Real Estate Act Rules? Choose the correct statements.

- The Rules may only be amended by the Provincial Legislature

- RECA posts the most current version of the rules on its website

- The Rules refer to the Standards of Practice for industry professionals

- When contemplating amendments to the Rules, RECA consults with industry professionals and stakeholders

Options:

A. Statements I, II and III

B. Statements II, III and IV

C. Statements I, III and IV

D. All Statements are correct

Correct Answer: B

Rationale: Here, the statements 2, 3 & 4 are correct as RECA is allowed to amend the rules and bylaws. They don’t have to go through the provincial legislature. Only we have to go through the provincial legislature. If there are any sort of amendments required to the Real Estate Act, only provincial legislature can amend it. However, the rules and bylaws can be amended by RECA. Thus, the 1st Statement is not correct. But the other Statements state that RECA will post most current version of the rules on their website. Rules are the standards of practice that we have to follow in our day-to-day. So, they apply to all Real Estate Industry Professionals and then any time when RECA wants to do changes, they will consult industry professionals i.e., us. They will get feedback from all the professionals who would be in that industry plus the stakeholders and change the rules. Therefore, Option B is correct.

These are some great examples of Real Estate Exam Questions that you can expect in the Alberta Real Estate Exams. The examples clearly show the level of complexity these questions can create. Thus, you should understand and learn the concepts whole-heartedly to crack the actual meaning of the questions. Once you breakdown the question in smaller parts, you start to understand the answer they are looking for and you can then answer it without any confusion.

Want to tackle Definition Questions in the Real Estate Exams more confidently? Get all the Important Real Estate Terminology right with Alberta Real Estate School.

Join Alberta Real Estate School for expert help with understanding the concepts of Real Estate and getting uncommon and detailed tutoring sessions personalized as per your needs. Get our personalized Notes designed to get you through the Real Estate Exams in the first attempt! Visit our list of Real Estate Tutoring Sessions for details.

If you have any doubts for Exam Preparation of any of the real estate courses or topics, reach out to us directly at 587.936.7779.

We hope you found this information useful. You can also listen to this blog on the Podcast Channel below. Stick to us for our latest updates.