Net Present Value (NPV) is a topic of Commercial Real Estate Course. It helps us to find out the Present Value of an Investment or a Property. It is a very important concept that you can expect to see in your Real Estate Exams. Calculation Net Present Value is a critical topic.

This strategy is useful for Commercial Projects and Properties to determine the Net Present Value of any particular Commercial Property, thereby calculating the Future Value of the Property in Present times. It is thus, one of the most important topics of Commercial Real Estate.

What is Net Present Value?

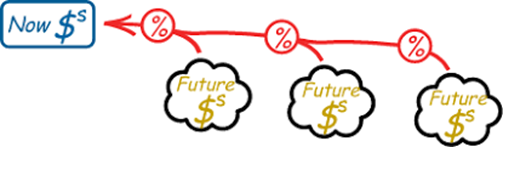

Net present value (NPV) is a method used to determine the current value of all future cash flows generated by a project,

This is a way to determine which projects are likely to turn the greatest profit.

So, for example, if someone were to buy a Commercial Building, then in that case, we would have a yearly Cash Flow (CF). Thus, we can say we would have the Net Operating Income that would come in from the Commercial Property. We have to consider the income that we are making from the business that is running in the said commercial building for the current year as well as over the years and calculate the worth of that Income / Profit on this Present day.

The reason we have to do this is because we have to see if the project (of buying the Commercial Building) is bound to make profits or not. We can use the calculation of finding Net Present Value of various projects to see if we are going to make profits in future and will be able to give us the highest Rate of Return.

Example of NPV Calculation

Refer the Video for seeing the Actual Calculation

Example

Tammy is a real estate professional representing a client who is interested in purchasing a commercial building. Tammy believes she can negotiate a purchase price of $1,600,000. The client wants to sell the property after 4 years for $2,000,000 and earn an annual return of 12%. Tammy projects the annual net operating income to be $300,000 for the first year, $315,000 for the second year, $325,000 for the third year, and $345,000 for the fourth year. What is the net present value for the investment?

A) $462,387.25

B) -$620,484.39

C) $1,574,763.55

D) $640,591.69

Solution

- CF (Cash Flow for Current Year) = 1,600,000

- CF1 (Cash Flow for First Year) = 300,000

- CF2 (Cash Flow for Second Year) = 315,000

- CF3 (Cash Flow for Third Year) = 325,000

- CF4 (Cash Flow for Fourth Year) = 345,000 + 2,000,000 = 2,345,000

- 12 I/YR

- Compute NPV (Net Present Value) = $640,591.69

So, the Correct Answer is D = $640,591.69.

This is NPV for Commercial Real Estate. You can tackle other Calculation Topics in the Commercial Real Estate Exams with our help and understanding of the topic. We can offer you concrete examples with Calculation Solutions and the tactics you can use within your Real Estate Calculators.

Want to learn the concept of Time Value of Money within your Commercial Real Estate Course? Hop On!

Join Alberta Real Estate School for expert help with understanding the concepts of Real Estate and getting uncommon and detailed tutoring sessions personalized as per your needs. Get our personalized Notes designed to get you through the Real Estate Exam in the first attempt! Visit our list of Real Estate Tutoring Sessions for details.

If you have any doubts for Exam Preparation of any of the real estate courses or topics, reach out to us directly at 587.936.7779.

We hope you found this information useful. You can also listen to this blog on the Podcast Channel below. Stick to us for our latest updates.