A common question before someone starts the course is: ‘Is this a good time to become a Real Estate Agent in Alberta?’ According to me, it is always a good time to become a realtor, but I am an educator, and I am very passionate about Real Estate, so for me, it is always a good time. However, is it really a good time to become a Realtor in Alberta?

Now, there are a few things to consider:

1- Alberta is growing 📈

We are witnessing a lot of migration from different parts of Canada into Alberta. Many people are moving because Real Estate in Alberta is more affordable compared to other places like Ontario and BC. Moving to a new province can feel overwhelming, especially when you’re on the hunt for a new place to live. Real Estate Agents can help clients with the legal requirements and provide more information about neighborhoods.

2- Newcomers 🛬

We also have a lot of immigrants coming to Canada. Even though they may initially land in Ontario or BC, many will eventually make their way to Alberta. Our population is trending upwards, which means we need more homes, and more people will be looking for properties to buy. All these people looking to purchase properties will need someone to help them with the process, especially if they are coming from outside the city, province, or a different country. They may not know the process of buying Real Estate in Alberta, and therefore, they will need someone to guide them through it. This will create job opportunities in this area.

3- Real Estate investors 💰

Another reason to become a realtor is the increase of investors moving into Alberta or looking to invest in Alberta. I am a Real Estate investor, and I love all aspects of Real Estate. From an investor’s point of view, Real Estate in Alberta is more affordable, and the return on investment is much better. You don’t need $2 million to buy a house in Alberta, which makes it easier for many investors to purchase properties in Alberta. That being said, if somebody is an out-of-town investor, they won’t know the process and the market, so they will need guidance to buy properties. Even if someone is an investor in Alberta, they may not have access to all the properties that realtors will have access to.

4- You control your schedule 📅

Being a Real Estate Agent in Alberta is a rewarding career. Unlike the traditional jobs, Real Estate Agents have the benefit of having a flexible schedule, especially for those who want a more work-life balanced life. You decide the times you will be working for your clients while maintaining a personal life.

5- No cap on your earnings 🤑

In a 9-to-5 job, your earnings may be restricted by the job market. However, when you work as a real estate agent, you are self-employed and can increase your processes, attract more clients, and, therefore, increase your earnings. Scaling up your earnings is easier as a self-employed Real Estate Agent, as you don’t need permission to earn more. You can be more competitive and actually earn more.

After highlighting these points, as I mentioned earlier, it’s always a good time to become a realtor, especially now, as our market dynamics are changing. Alberta is growing, and its economy is expanding. We are witnessing a lot of migration, resulting in more people looking for houses, whether it’s for investment or for living. I expect this trend to continue. Additionally, as the Bank of Canada possibly changes its interest rates and lowers them over time, we are likely to see even more people entering the housing market.

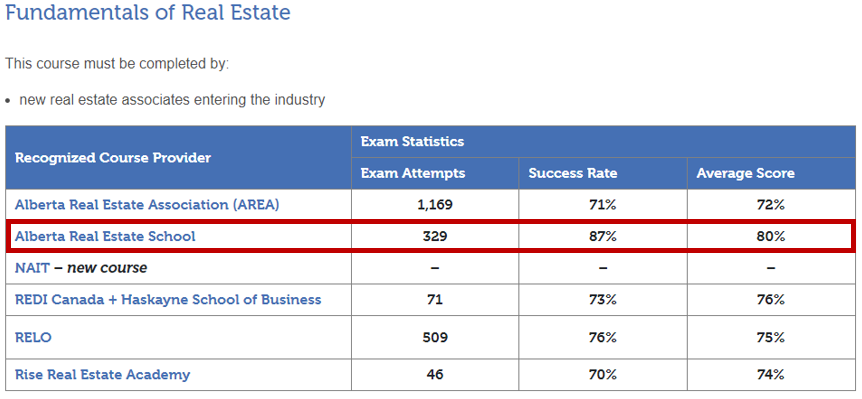

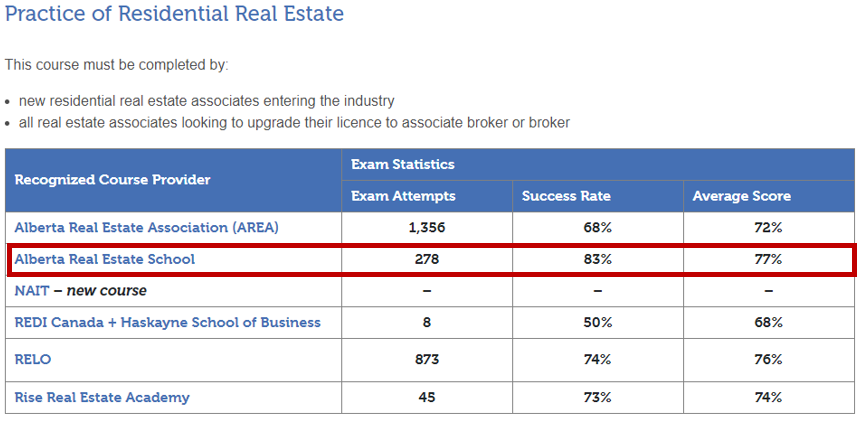

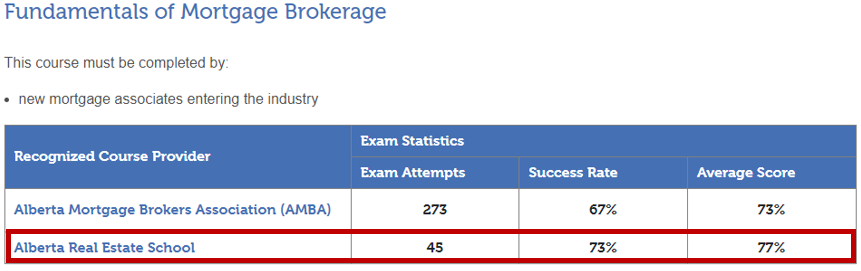

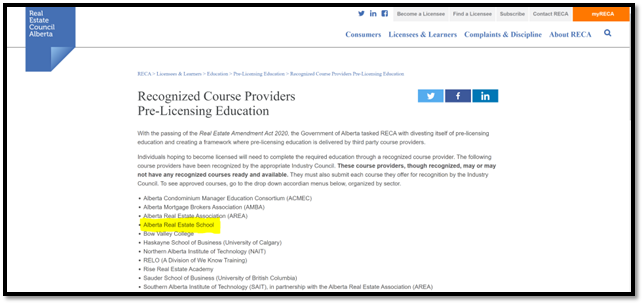

At Alberta Real Estate School, we equip future Real Estate Agents and Mortgage Associates in Alberta with the necessary skills. Pass your Alberta Real Estate exam on the first attempt.

Check out the list of courses we offer for you:

✅Fundamentals of Real Estate Exam Prep Course

✅Fundamentals of Real Estate Mock Test

✅Practice of Residential Real Estate

✅Practice of Residential Real Estate Exam Prep Course

✅Practice of Residential Real Estate Mock Test

✅Fundamentals of Mortgage Brokerage

✅Fundamentals of Mortgage Brokerage Mock Test

For more information, you can give us a call at 587-936-7779. We are open Monday – Friday from 8:30am to 5pm MST.

💯 We train tomorrow’s top Real Estate Agents and Mortgage Associates in Alberta!