Real Estate is a big market that encompasses the many facets of a real property, including development, appraisal, marketing, selling, leasing, renting and many more. The Alberta Real Estate Industry is no different.

Anyone planning to know the process of or become a Real Estate Professional in Alberta, must learn about the important institutions and government authorities that are involved in the process. Let’s understand who’s who in the Alberta Real Estate Industry and what role does each of the member’s play.

Real Estate in Canada

In Canada, Real Estate Agents are represented at 3 levels:

- Locally by their Board/Association

- Provincially by their Provincial Association

- Federally by the Canadian Real Estate Association (CREA)

Canadian Real Estate Association (CREA)

The Canadian Real Estate Association (CREA) is the Federal Canadian Real Estate Board and is one of Canada’s largest single-industry Associations. Our membership includes more than 150,000 Real Estate Brokers, Agents, and Salespeople, working through 78 Real Estate Boards and Associations across Canada.

REALTOR® – The Code

CREA has coined the two primary national trademarks for Real Estate Professionals in Canada – MLS® and REALTOR®. CREA protects and promotes the two trademarks with legal discrepancies.

Not just anyone can call themselves a REALTOR®. To do so, real estate professionals must either be direct members of their association or be members of both their local real estate board and CREA, depending on the province. As well, they must abide by the ethical standards laid out in the REALTOR® Code.

They are also the operator of realtor.ca.

Role of CREA in the Real Estate Industry

- Assists Real Estate Agents to serve their clients better.

- Enhances professionalism and ethics in the Canadian Real Estate Industry.

- Produces accurate, up-to-date information and analysis on Canadian Real Estate.

Real Estate in Alberta

Alberta is a vast province with a number of territories, cities and towns that take up the land in Alberta.

Alberta Real Estate Association (AREA)

Alberta Real Estate Association (AREA) is the Professional Provincial Body of Real Estate in Alberta. It represents the interests and concerns of more than 11,000 Alberta REALTORS®, from the 10 Local Real Estate Boards/Associations. They provide strategic leadership and advancement in the Real Estate Profession in Alberta through member-centric services, advocacy, and professional development.

Real Estate Boards in Alberta

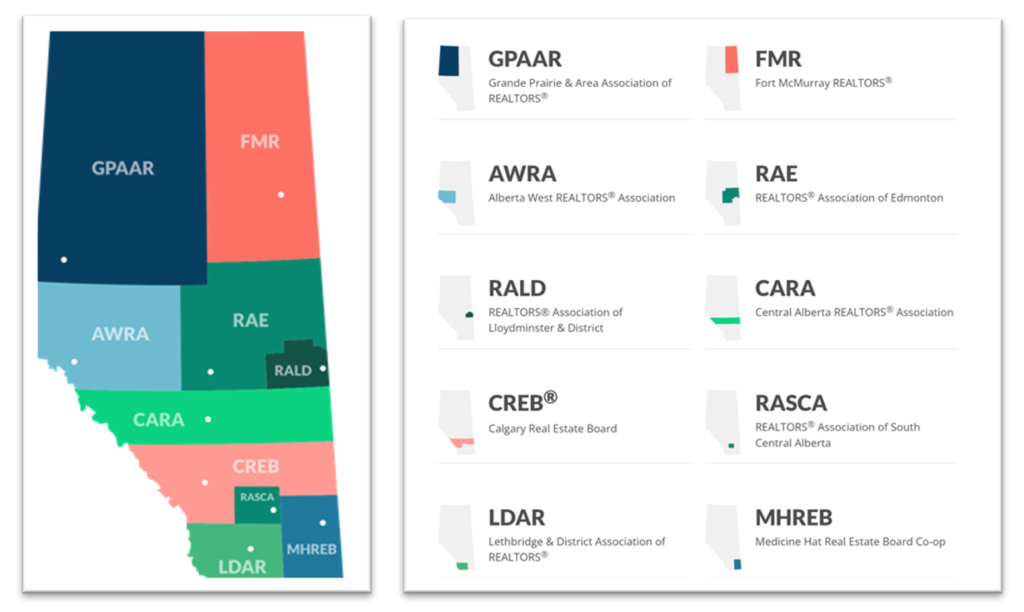

Alberta is a big province comprising of 19 cities, 2 urban service areas and 10 towns. Real Estate in Alberta is distributed among 10 Local Real Estate Boards that manage the Real Estate functioning in their own designated areas. Below is a detailed list with area specifications as shown in the Alberta Map.

The 10 Local Real Estate Boards of Alberta

- Western Alberta – Alberta West REALTORS® Association (AWRA)

- Central Alberta – Central Alberta REALTORS® Association (CARA)

- South-Central Alberta – REALTORS® Association of South-Central Alberta (RASCA)

- Edmonton – REALTORS® Association of Edmonton (RAE)

- Calgary – Calgary Real Estate Board (CREB)

- Lloydminster – REALTORS® Association of Lloydminster & District (RALD)

- Medicine Hat – Medicine Hat Real Estate Board Co-op (MHREB)

- Lethbridge – Lethbridge & District Association of REALTORS® (LDAR)

- Grand Prairie – Grande Prairie & Area Association of REALTORS® (GPAAR)

- Fort McMurray – Fort McMurray REALTORS® (FMREB)

Real Estate Licensing Education in Alberta

Real Estate Licensing Education is handled by the Real Estate Council of Alberta (RECA).

Real Estate Council of Alberta (RECA)

Real Estate Council of Alberta (RECA) is the governing authority for Real Estate Licensing in Alberta. It sets, regulates, and enforces standards for all branches of Real Estate, Property Management, Condominium Management, & Mortgage Brokerage licensees in Alberta. RECA is responsible for issuing, renewing and debarring licenses for Real Estate and Mortgage Brokerage Professionals in Alberta.

As of now, RECA is issuing licensing Education Courses for Real Estate and Mortgage Brokerage in Alberta. You have to get registered with RECA in order to apply for licensing courses for both the industries. They have set eligibility parameters based on documentation, education and English proficiency requirements that need to be fulfilled in order to be approved for the same. Once registered, they provide education materials through their myRECA.ca portal.

International Education Assessment for Real Estate

If you have received international education or are an immigrant to Canada who wants to apply for Real Estate pre-licensing courses, then there are certain assessment institutions available. They are appointed and approved by the Canadian Government that help you to assess your international education as well as English language requirements.

RECA recommends using IQAS (International Qualification Assessment Service) by the Alberta Government. IQAS can assess international education of immigrants or international students who want to apply for Real Estate pre-licensing courses with RECA. For the convenience of its applicants, it coordinates the results with RECA without involving the applicants in the process.

ICES (International Credential Evaluation Service) is another credential evaluation service provider for international education of immigrants with English language assessment. It is an initiative by BCIT (British Columbia Institute of Technology) in British Columbia (BC), Canada. It is recommended by RECA if you did not English as a subject as well as the language of instruction in your high-school diploma equivalent institution in your home foreign country (any country other than Canada where the applicant has received his/her high school education).

Insurance for Real Estate Agents in Alberta

As Real Estate Agents, you have to take insurance for your real estate business and license. It is useful for us as Realtors® as it helps us protect our license against odds and unexpected events while performing real estate practice.

REIX (The Real Estate Insurance Exchange) is the one and only Real Estate Insurance Exchange for Real Estate Professionals in Alberta and Saskatchewan. It Provides Mandatory Professional Liability Insurance Coverage to all Real Estate Industry Professionals. Its participants are called “Subscribers”.

It offers the mandatory Errors and Omissions (E&O) Insurance Program. The premiums paid to REIX by the Real Estate Agents are used to pay the costs of defending claims and surplus funds are used to keep premiums low. REIX is a mandatory program which means that all real estate licensees in Alberta and Saskatchewan must be insured by them.

REIX provides cost-effective, financial protection for industry members in Alberta and Saskatchewan. They act on behalf of their subscribers to protect real estate professionals from losses that result from errors, omissions and negligent acts while performing their real estate duties.

Voluntary Foundation for Real Estate Agents in Alberta

AREF (Alberta Real Estate Foundation) A voluntary association for the Real Estate professionals of Alberta. It was created under the Real Estate Act to help educate and train Real Estate Professionals in Alberta.

It is the association who is responsible for creating the pre-licensing education for real estate courses in Alberta.

These are some of the important bodies of the Real Estate Industry in Alberta that you should know if you are planning to become a part of that industry. Hope this helps to draw an outline of the necessary institutions and learn about their basic features and responsibilities.

Now, it’s time for ARS – Alberta Real Estate School

Alberta Real Estate School helps you Pass your Real Estate Licensing Exams on the first attempt!

We are independent of RECA and offer Exclusive Real Estate Training Courses along with Focused Study Guides, Detailed Video Sessions which covers Exam Preparation Materials like Practice Exam Questions, Quiz, and our hand-picked Important Topics.

Hope you enjoyed the blog. Join Alberta Real Estate School for expert help with learning Real Estate & Mortgage Brokerage Courses.

Are you wondering How to Become a Real Estate Agent in Alberta now? Don’t worry, we have got that too!

Get our Focused Study Guides, Exclusive Video Courses and “In-demand” Tutoring Sessions to get you through the Real Estate Exams on the first attempt!

Get in touch with at 587.936.7779 or support@albertarealestateschool.com.

Happy Studying!