Today, we will understand what Total Debt Service or TDS Ratio is and how to calculate the TDS Ratio in the mortgage application for a real estate property.

If you have ever applied for a Mortgage or have come across a Mortgage Professional, you must have heard of 2 main ratios – Gross Debt Service or GDS Ratio & Total Debt Service or TDS Ratio. Mortgage professionals use these 2 ratios to determine if borrowers can afford to pay off the mortgage for a specific real estate property that they are dealing with. TDS Ratio is thus, an essential indicator of mortgage affordability and approval.

If you are planning to become a Mortgage Professional, you need to understand what GDS and TDS are and how to calculate these ratios. For now, let’s understand the concept and calculation of TDS Ratio step-by-step.

First of all, let’s understand what are Debt Service Ratios?

So, what are Debt Service Ratios (DSRs)?

Debt Service Ratio (DSR) or Debt Service Coverage Ratio (DSCR) is used in the calculation of mortgage approval for a real estate property. It is a popular benchmark used in the measurement of an entity’s ability to produce enough cash to cover its debt payments, including repayment of principal and interest (on the mortgage) on both short-term and long-term debt. This ratio is often used when the entity applying for a mortgage has any borrowings on its account such as bonds, loans, or lines of credit.

It is also a commonly used ratio in a leveraged buyout transaction, to evaluate the debt capacity of the target company, along with other credit metrics such as total debt/EBITDA multiple, net debt/EBITDA multiple, interest coverage ratio, and fixed charge coverage ratio.

Thus, as we understood, there are 2 types of Debt Service Ratios:

- GDS (Gross Debt Service) Ratio

- TDS (Total Debt Service) Ratio

What is GDS Ratio?

GDS refers to Gross Debt Service Ratio. As we understood, it helps us determine whether a person or an entity is eligible for the intended amount of mortgage or not. GDS is the percentage of your monthly household income that covers your housing costs and not any other debts, unlike TDS. It includes housing costs like Principle (P), Interest (I), Property Taxes (T), and Heating Costs (H). It also includes 50% of the Condominium Fees, if the property is a Condominium.

What is TDS Ratio?

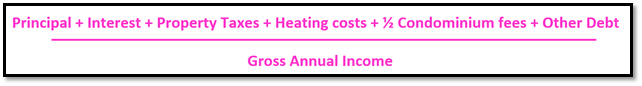

TDS refers to Total Debt Service Ratio. As we understood, it helps us determine whether a person or an entity is eligible for the intended amount of mortgage or not. TDS Ratio is the percentage of your income needed to cover all of your debts.

Thus, it is GDS (PITH) + Other Debt.

Secured and Unsecured Debt

Secured Debt

Secured Debt is debt which is backed by a security. The lender has a financial security over the debt he has offered to the borrower.

For instance, when a borrower applies for a mortgage for his property, the property is the security for the lender. If the borrower defaults in mortgage payments or runs bankrupt and seems unable to pay for the mortgage, the lender will take over the security, which is the property itself in this case and will recover his mortgage from that.

Examples of Secured Debt include: Mortgage on a property, Car Loan, Secured Line of Credit, etc.

Secured Debt Calculation in TDS Ratio –

For Secured Debts in TDS Ratio Calculation, we will include a Monthly Payment of 1% of the Outstanding Balance.

For Example: If $10,000 are outstanding on a Secured Line of Credit, then the payment included in the TDS Ratio Calculation will be:

$10,000 x 1% = $100

Unsecured Debt

Unsecured Debt , on the other hand is the debt which is not backed by a security. The lender does not have a financial security for the debt he has offered to the borrower.

For instance, when someone makes a payment from their Credit Card of a bank, the bank do not have strong financial security from the person who is using their credit card. If the borrower defaults in his credit card payments, they may charge him fees for late or non-payments, but they cannot get a hold of the person, if his account is nil or if he runs away to a different country.

Examples of Unsecured Debt include: Student Loans, Unsecured Line of Credit, Credit Card Payments, etc.

Unsecured Debt Calculation in TDS Ratio –

For Unsecured Debts in TDS Ratio Calculation, we will include a Monthly Payment of 3% of the Outstanding Balance.

For Example: If $10,000 are outstanding on an Unsecured Line of Credit, then the payment included in the TDS Ratio Calculation will be:

$10,000 x 3% = $300

Factors affecting TDS Ratio

The factors that affect GDS Ratio include:

- Principle Amount (P)

- Interest Rate (I)

- Taxes on the Property (T)

- Heating Costs (H)

- 50% Condominium Fees (C) – if the property is a Condominium

- Other Debt (O) – Secured or Unsecured

TDS Formula:

Now, let’s understand the calculation of TDS Ratio with some examples.

Sample Questions

Example 1

Merissa and David Smith wish to purchase a house subject to financing. Their yearly gross income is $72,000. Their monthly mortgage payment is $1,400 that includes the principal and interest. The property taxes are $4,200 for the year. The estimated monthly heating costs for the property they are interested in buying are $120.00. In addition to this, they had borrowed $12,000 from their secured line of credit to cover their wedding expenses last year.

Would Merissa and David qualify for the mortgage on the desired property?

The Variables are:

- Gross Household Monthly Income: $72,000 per year = 72,000 / 12 = $6000 per month

- Mortgage Installment (Principal + Interest): $1,400 per month

- Property Tax: $4,200 per year = 4,200 / 12 = $350 per month

- Heating Cost: $120 per month

- Secured Line of Credit: $12,000 x 1% (as it is unsecured debt) = $120 per month for TDS Calculation

Calculation:

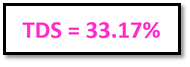

- Step 1: Total Monthly Housing Expenses = PITHO = $1,400 + $350 + $120 + $120 = $1,990.00

- Step 2: TDS = PITHO / Gross Monthly Income = $1,990 / $6,000 = 0.3317

In this example, the TDS Ratio is less than 42%. Therefore, the couple qualifies for the mortgage when applying the TDS Calculation.

Example 2

Jonathan and Lia want to buy a condominium property in Calgary. They have applied for mortgage on that property. Their joint annual income is $150,0000. The purchase price of the property is $725,000 with a monthly payment of $3,000 including principal and interest. The property taxes for the property are $6000 per year. Other property expenses include monthly condominium fees of $300 and monthly heating cost estimated at $250.00. They also have a car payment of $400 and credit card debt of $15,000.

Would Jonathan and Lia qualify for the mortgage?

The Variables are:

- Gross Household Monthly Income: $150,000 per year = $150,000 / 12 = $12,500 per month

- Mortgage Installment (Principal + Interest): $3,000.00 per month

- Property Tax: $6,000 per year = $6,000 / 12 = $500 per month

- Condo Fees: $300 per month

- Heating Cost: $250 per month

- Car Payment: $400 per month

- Credit Card Payment: $15,000 per month x 3% (as it is unsecured debt) = $450 per month for TDS Calculation

Calculation:

- Step 1: Total Monthly Housing Expenses = PITHOC = $3,000 + $500 + $250 + $150 + $400 + $450 = $4,750.00

- Step 2: TDS = PITHOC / Gross Monthly Income = $4,750 / $12,500 = 0.38

In this example, the TDS Ratio is less than 42%. Therefore, the couple qualifies for the mortgage when applying the TDS Calculation.

So, this was TDS Calculation for you guys. Stick around for more of such calculations and mortgage related topics.

Are you wondering How to Calculate GDS now? Don’t worry, we have got that too!

Get our Focused Study Guides, Exclusive Video Courses and “In-demand” Tutoring Sessions to get you through the Real Estate Exams on the first attempt!

Get in touch with at 587.936.7779 or support@albertarealestateschool.com.

Happy Studying!